Owning a home in New Zealand has become quite an issue for first time home buyers (FHBs) especially in the recent housing boom. Pulling together a deposit and being able to afford a mortgage are all things that stand in the way for FHBs. So is it any wonder that FHBs are finding new ways to get a deposit and buy a house?

‘Kiwisaver’ is a retirement savings scheme that most people contribute to as soon as they start work. It’s a scheme that enables you to save as you earn to create a future nest egg for retirement. However, many young New Zealanders are currently flocking to convert their future retirement nest eggs into heavily mortgaged houses, by withdrawing funds from Kiwisaver and using this as a deposit for a first home.

As the official RBNZ figures indicate first home buyers are now forming an increasingly significant portion of mortgage borrowing. So is it a problem that FHBs are raiding their Kiwisaver and what effect does this have on the future?

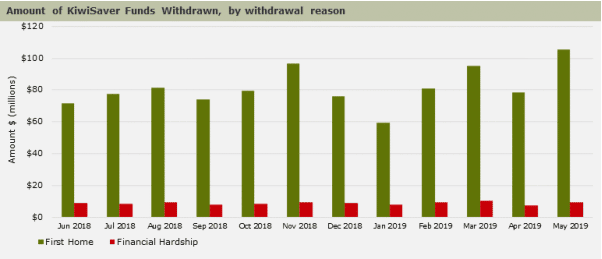

The official Kiwisaver figures show that in May some $105.6 million (up 18.1% from $89.4 million in May 2018) was emptied from Kiwisaver accounts to buy a first house. Some 4230 account holders (up from 3950 in May 2018) made these withdrawals.

That means, on average, the amount of money withdrawn was a touch under $25,000 per account.

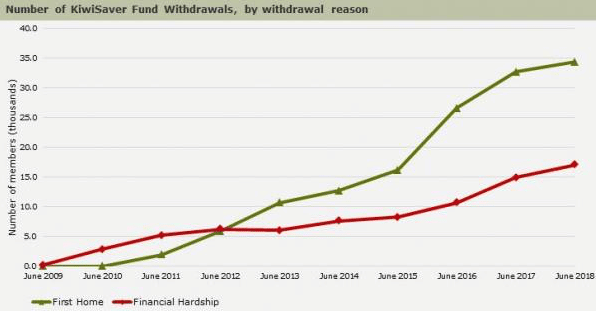

Therefore, something like half of FHBs’ total deposits for buying houses is possibly being sourced from Kiwisaver accounts. This figure is quite alarming and to see how much it has jumped in recent years could be a cause for concern.

One of the main ideas of Kiwisaver is to diversify your risk. However, we have thousands of young Kiwis tipping all or most of their money out of their Kiwisaver accounts and into a house. The question is how long will it take them to get back up to speed again in terms of their Kiwisaver savings? And what effect does it have on the economy?

These questions are all good ones and some of them can’t be answered straight away but what we do know is that Kiwisaver was introduced to help fix future savings so the risk of it actually making things worse is a concern especially if FHB’s are putting all their eggs in one basket.

If you are thinking of being a Kiwiraider then have a chat with one of our advisers to get an informed opinion and then make your decision. Call us on 09 486 6528 or drop us an email at info@fdgl.co.nz