Disaster strikes. The unthinkable happens and suddenly you need to fork out a lot of money to replace, rebuild or recover. It’s a good job your insurance covers all your losses… But does it?

Underinsurance is when you take out an insufficient insurance policy to cover costs when things go wrong. It might sound like another piece of jargon aimed at confusing the policy holder, but it’s important not to ignore it.

Recent research by the Financial Services Council into the life insurance industry has found that despite people in New Zealand being aware of the importance of insurance, we aren’t being careful enough to check we have the right one – one that will actually pay us the amount we need in an emergency.

So why are so many Kiwis gambling on everything? Here’s what you need to know about underinsurance.

What is underinsurance?

If the total amount you are insured to cover your home, car or contents is less than it would actually cost to rebuild your property or replace your belongings then you are underinsured. In terms of life insurance this would involve accurately covering financial commitments following illness or injury in terms of income protection.

Many people are deterred from putting forward their actual sum due to high premiums, resulting in a policy that is lower than the true value. Regardless of how much you believe an item or property is worth it’s important to insure it to the equivalent replacement or market value to avoid the surprise and massive disappointment if ever making a claim.

What are the risks?

Underinsurance is a real risk to your ability to recover after a catastrophe, which could be anything ranging from fire, illness or even a natural disaster. Perhaps the biggest risk of underinsurance is that if you do need to make a claim your insurer may either give you a reduced payout or void your policy altogether.

And it’s both personal and business insurance that can be affected! Small businesses can find it difficult to recover after their insurance payout is lower than expected, or needed. It’s the same for life or income insurance – if you were ill and out of work for a long period, would your insurance payout be enough to cover all your costs?

“But it will never happen to me” – this is a common thought when dealing with more serious insurances, but don’t risk everything. Make it an absolute priority to ensure your sums are right.

How do I know if I’m underinsured?

Due to the complexity of factors involved, there is a large risk that you may have underestimated exactly how much it would cost for a total loss of property, vehicle or belongings. You’d be surprised just how much your home and contents are worth!

You could be underinsured if you haven’t reviewed how your situation has changed over the past year. Renovating a property, adding new items, or not fully considering the costs of replacing, rebuilding or recuperating any financial commitments can all mean your policy is underinsured.

A good way of working out the total value of your assets is by splitting them into rooms and calculating the value of all items in each room. Use this alongside an insurance calculator from your insurers website. The more information you provide, the more accurate the recommended sum will be.

I think I’m underinsured – what can I do next?

Firstly, understand the importance of how you will cover costs if anything happens to you, your family, your home or your belongings. It’s a scary thought but that’s why you should start by regularly reviewing your policies especially if you change home locations, expand or add assets – as life changes, so will your insurance needs.

Look at your debts and savings and speak to a financial advisor to get a better picture of your current and future needs. Here at FDG

How does New Zealand compare to the rest of the world?

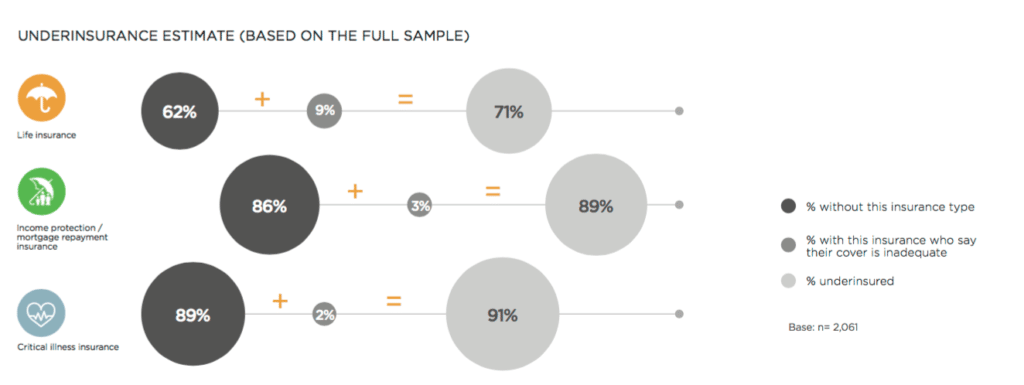

We might have one of the best rates of insurance in the world but Kiwis are not great at valuing their property and contents correctly before they insure. The Financial Services Council’s recent study “Gambling on Life” found that only 29% of Kiwis have any kind of life insurance and a tiny 9% are being sufficiently insured for critical illness. Underinsurance is a big issue here, especially when factoring in the higher risk of natural disasters. The 2011 Christchurch earthquakes changed how insurance worked in New Zealand and unfortunately saw a big rise in premiums leading more and more people to be underinsured as they faced those

Don’t fall into the trap of paying less now and being caught short later.

Need more help or advice? Contact us to discuss your insurance options further and ensure you’re properly covered for whatever life throws at you.